Many people start an online business and wait months before they start earning money. This is disheartening because they struggle to convert visitors, they struggle to rank for their keywords, and even more, they struggle to pull traffic.

While it’s important to spend time on building your brand and generating sales leads, it’s downright vital to quickly cultivate a steady stream of what accountants call “free cash flow” — that is, the amount of cash coming into your company over and above all of your expenses. After all, if you don’t have money, you won’t be around long enough to worry about those other things.

If possible, keep 10 percent to 20 percent of monthly revenues on hand because at that point, in most companies, you’ll be able to reinvest into the growth of your business — from purchasing additional product or service lines to roping in more suppliers or even building up your team when you need to.

8 Ways to Improve Cash Flow

1. Know your expenses

Get 50% Discount to Master ALL Aspects of Digital Marketing That Can Earn You $2,500 - $5,000 a month (Even if you are a complete beginner!)

Our students that intentionally implement what they learn from our digital marketing course make back the entire course fee within a single month or more after completing our course because our course gives them many income generating options with unlimited earning potential with no age or location barrier. The best part is no technical skills are required.

An opportunity to change your lifestyle and make money working from anywhere in the world. The results our students get from our digital marketing course prove this could be applied to any market or country and that it is designed for any skill level and work background.

*By signing up, you agree to our privacy policy and terms of service.

Through coupon sites like Groupon and BuyWithMe or even on your own — can help you attract new customers, selling anything at a loss won’t help you generate a positive cash flow.

My view? Never discount. But if you do, know the costs and impact of what you’re offering and be prepared for the fallout. Among other things, you’ll need to know your overall cost basis.

You should also know how much you should ideally charge, the cost of your offer and the profit margins on your product or service. How else will you know if you are operating at a profit or loss? To do the math, see our break-even calculator.

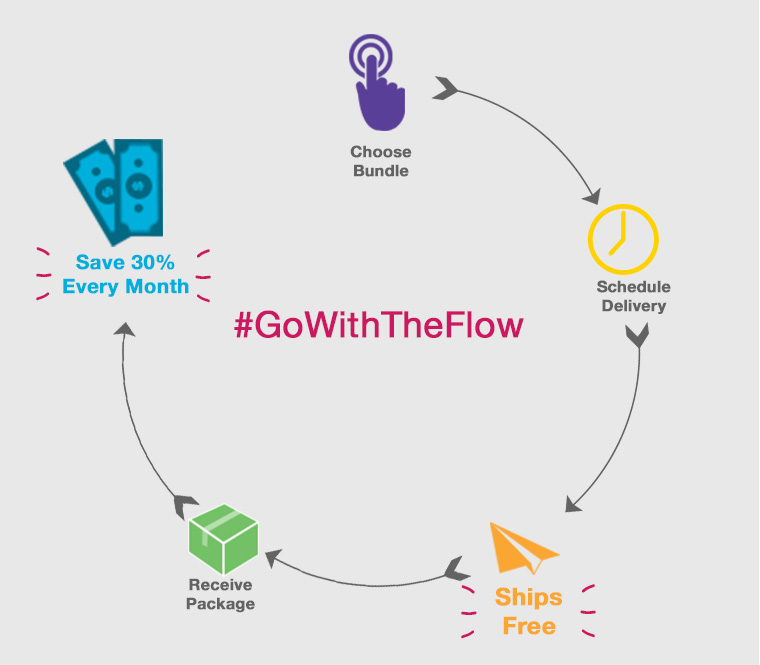

2. Bundle products and services

Even though discounting isn’t always recommended, adding value is. By creating bundles of products or services, for instance, businesses can inject tremendous amounts of perceived — and tangible — value into their offerings for very little cost.

A good example is the maintenance agreements some car manufacturers provide with the purchase of a new car. Not only does that type of offer help allay a major concern or frustration customers have — paying for a breakdown or time lost at the dealership — it also offers real value in terms of limiting out-of-pocket maintenance costs.

Put more simply, you can increase your price point initially since you’ve helped lower a perceived risk by offering something as basic as a guarantee.

3. Create a back-end product or service

If you know your initial offer to reel in new customers won’t be profitable, find ways to create higher price points on back-end products or services.

Perhaps the first hour of catering is free, but subsequent hours shoot up in price. Or maybe an attorney will agree to draft your will for less if she thinks you’re a likely candidate for estate-planning consultations in the future.

4. Encourage repeat business

If you’re in a volume-driven business like retail, landing repeat shoppers is your holy grail for cash flow, profit and growth. In most cases, you won’t start to profit on a customer until the third, fourth or even fifth transaction. For this reason, you need to devote your efforts toward getting customers to come back — and more often.

Consider loyalty programs, VIP offers and other frequent-shopper programs, which can be ideal vehicles for systematizing repeat business.

Also, keep in mind that the word “free” is a popular incentive among shoppers, and the costs of funding a freebie may easily be covered as long as you’re dealing with excess inventory or low-cost, but valuable add-ons.

5. Pre-sell products or services

For owners who want to encourage sales sooner, pre-sell your products or services. You might couch the pre-sale as a way for consumers to plan for their future or get a jump on shopping. You can also offer to take old, outdated products back at a pre-arranged price.

6. Put Idle Cash to Work

This is a smart way to increase cash flow for your business. Instead of letting excess funds sit in a low-interest account, consider investing in short-term opportunities that can generate returns. For instance, you might invest in high-yield savings accounts, certificates of deposit (CDs), or even short-term bonds.

Additionally, consider using idle cash to purchase inventory or equipment that can enhance your operations and lead to increased sales.

When you manage your cash reserves, you can ensure that every dollar is working hard for your business, ultimately boosting your overall cash flow.

7. Protect Cash at All Times

Cash flow is essential for the health of your business. To protect your cash, you need to start by implementing strong financial controls to monitor expenses and prevent unauthorized spending. This review will help you to identify any discrepancies or unusual transactions in your financial statements.

Additionally, establish a cash reserve to cover unexpected expenses or downturns. This safety net ensures you can maintain operations during challenging times. Finally, consider using secure payment methods and invoicing systems to minimize the risk of fraud.

8. Plan for Future Cash Needs

Planning for future cash needs is crucial for maintaining a healthy cash flow in your business. As a business owner, you need to forecast how much cash you will need for the upcoming months, taking into account seasonal fluctuations and expected expenses. This will help you identify potential shortfalls in advance.

Also, consider creating a budget that outlines your projected income and expenses, allowing you to allocate funds effectively. Additionally, explore financing options, such as lines of credit or short-term loans, to ensure you have access to cash when needed.

Are you a new business owner and do you think you need that extra cash?

What Is Cash Flow?

Cash flow refers to the net cash and cash equivalents that move into and out of a business over a specific period. It encompasses all cash received (inflows) and cash spent (outflows). Positive cash flow indicates that a company has more money coming in than going out, which is essential for covering expenses, reinvesting in the business, and providing a buffer against financial challenges. Conversely, negative cash flow can lead to liquidity issues. When you understand your cash flow, it will help you assess a business’s financial health and operational efficiency, as it directly impacts its ability to sustain operations and grow over time.

How to Do a Cash Flow for a New Business?

To create a cash flow statement for a new business, start by estimating your expected cash inflows and outflows. Begin with projected sales revenue based on market research and pricing strategies. Then, list all anticipated expenses, including fixed costs (like rent and salaries) and variable costs (like materials and utilities).

Once you have your estimates, organize them into a monthly format for at least the first year. This will help you visualize when cash is expected to come in and when it will go out. Finally, update your statement as actual figures come in to allow you to adjust your forecasts and manage your cash flow effectively.

How to Maintain Cash Flow in a Small Business?

Maintaining cash flow in a small business involves several key strategies. First, regularly monitor your cash flow statements to identify trends and potential shortfalls. Implementing efficient invoicing practices can also help ensure timely payments from clients; consider offering discounts for early payments or charging late fees.

Additionally, keep expenses under control by negotiating better terms with suppliers or finding cost-effective alternatives. Finally, diversify your revenue streams to reduce dependence on any single source of income, which can help stabilize your cash flow over time

Conclusion

Increasing cash flow is important for the success and longevity of your business. You need to implement strategies that can help you increase and manage your cash flow for future needs. I want you to know that maintaining a healthy cash flow requires ongoing attention and proactive management.

To review your current cash flow practices, you need to identify areas for improvement. Start by setting specific goals for enhancing your cash flow and start implementing these strategies today.

With dedication and the right approach, you can ensure your business thrives and remains financially healthy for years to come.

Did you enjoy this article?

We give away 50% of our digital marketing resources. Right now, you can check out our comprehensive digital marketing course to learn how you can increase your sales and customer base online faster. It is absolutely FREE.

More resources

10 Things Your Business Website Needs (Part 1)

10 Things Every Business Website Needs (Part 2)

Tips on how conversion and acquisition can grow your business online